Starting a business needs careful preparation, critical financial decisions, and the completion of a number of legal tasks. Read about each stage by scrolling down.

Table of Contents

Toggle1. Perform market research

Market research will inform you whether your idea has a chance of becoming a profitable business. It’s a method of gathering information about potential clients and existing businesses already running in your area. Use that data to get a competitive advantage for your organization.

Market research will inform you whether your idea has a chance of becoming a profitable business. It’s a method of gathering information about potential clients and existing businesses already running in your area. Use that data to get a competitive advantage for your organization.

2. Write your business plan

Your business plan is the foundation of your organization. It’s a road map for structuring, running, and growing your new firm. You’ll make use of it to encourage others that working with you or investing in your business —is a great decision.

Your business plan is the foundation of your organization. It’s a road map for structuring, running, and growing your new firm. You’ll make use of it to encourage others that working with you or investing in your business —is a great decision.

3. Funding for your business

Your business plan will help to determine how much funds you will require to start your business. You’ll need to raise money or borrow money if you don’t already have that much available. The good news is that getting the money you require is easier than before.

4. Choose a business location

One of the most important decisions you’ll make is where your company will be located. Whether you’re starting a physical store or an online website, the decisions you make will have an impact on your taxes, legal responsibilities, and revenue.

One of the most important decisions you’ll make is where your company will be located. Whether you’re starting a physical store or an online website, the decisions you make will have an impact on your taxes, legal responsibilities, and revenue.

5. Define a business structure

The legal structure you choose for your company will affect your business registration requirements, tax liability, and personal liability.

The legal structure you choose for your company will affect your business registration requirements, tax liability, and personal liability.

6. Choose a name for your business

Finding the correct name is complicated. You’ll want one that defines your brand and expresses your personality. You should also ensure that your company name isn’t currently in use by someone else.

Finding the correct name is complicated. You’ll want one that defines your brand and expresses your personality. You should also ensure that your company name isn’t currently in use by someone else.

7. Incorporate/Register your business

Once you’ve decided the perfect company name, it’s time to register it and secure your brand. If you are conducting business under a name other than your own, you must register with the government and likely your state government as well.

Once you’ve decided the perfect company name, it’s time to register it and secure your brand. If you are conducting business under a name other than your own, you must register with the government and likely your state government as well.

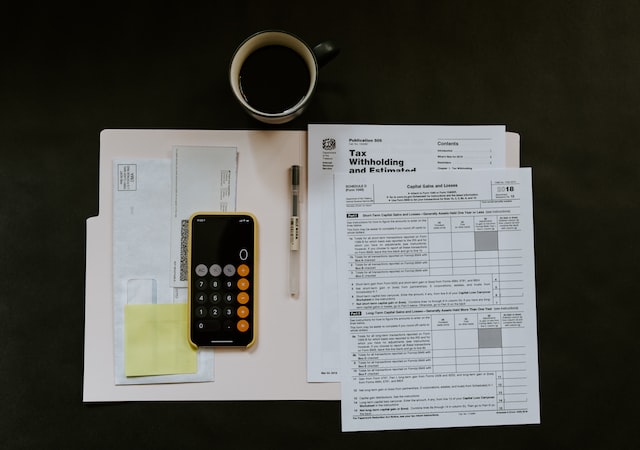

8. Get tax IDs

When starting and expanding your business, you’ll need to create a bank account and pay taxes. To do this, you’ll need your employment identification number (EIN). It’s similar to your company’s social security number. Some, but not all, states also require you to have a tax ID.

When starting and expanding your business, you’ll need to create a bank account and pay taxes. To do this, you’ll need your employment identification number (EIN). It’s similar to your company’s social security number. Some, but not all, states also require you to have a tax ID.

9. Apply for licenses and permits

Maintaining legal compliance will help your firm run smoothly. Depending on your industry, state, region, and other criteria, you may require different licences and permissions for your firm.

Maintaining legal compliance will help your firm run smoothly. Depending on your industry, state, region, and other criteria, you may require different licences and permissions for your firm.

10. Open a bank account

A small company checking account can assist you in dealing with legal, tax, and day-to-day concerns. The good news is that it’s simple to set up if you have the necessary registrations and documents.

A small company checking account can assist you in dealing with legal, tax, and day-to-day concerns. The good news is that it’s simple to set up if you have the necessary registrations and documents.

Great congratulations! It’s time to cut the big ribbon. Your company is now officially open. Now focus on running and expanding your business.

Great congratulations! It’s time to cut the big ribbon. Your company is now officially open. Now focus on running and expanding your business.